Chime Direct Deposit Time

Are your Direct Deposits taking much time? Switch to Chime!

Chime virtual bank ensures instant transfers. It sends a word whenever a direct deposit arrives.

The Chime Direct Deposits also have a limit.

Banking Services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa ® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. And may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank. @quarterris @Chime why didn't @Chime let customers now that there is problems receiving direct deposits today. My lights just got turned off cause my deposit was supposed to be here at 12 pm My lights just got turned off cause my deposit was supposed to be here at 12 pm. Bank Transfer Initiated Through the Chime Mobile App or Website: Up to 5 (five) business days from the date the transfer was initiated (Monday-Friday) excluding federal holidays. Bank Transfers from an External Account: These deposits are typically received within 3 (three) business days from the date the transfer was initiated by the originating bank. If you receive direct deposits to your Spending Account, you can get access to your paycheck up to two days earlier. Faster access to funds is based on comparing traditional banking policies and paper check deposits from employers and government agencies to deposits that are made electronically. To set up direct deposit, provide your bank routing number and your Chime account number to your payroll. 18 minutes ago Chime direct deposit late. Chime for me has consistently posted shortly right after 10 PM on Wednesdays, albeit tonight posted around 10:57. Chime members with total monthly qualifying direct deposits of 0 or more are eligible to enroll. PayPal is always slower than chime but generally sometime after midnight it shows up.

Direct Deposits allow you to deposit funds directly to the bank account, but these deposits are sometimes delayed due to holidays or weekends. Nevertheless, Chime always has an answer to every question. The blog will give a piece of detailed information about Chime Direct Deposits. It will also help you know about Chime Direct Deposits limits.

Chime Direct Deposit Late

Let us begin!

Now, let us learn how to begin working with Chime Direct Deposits.

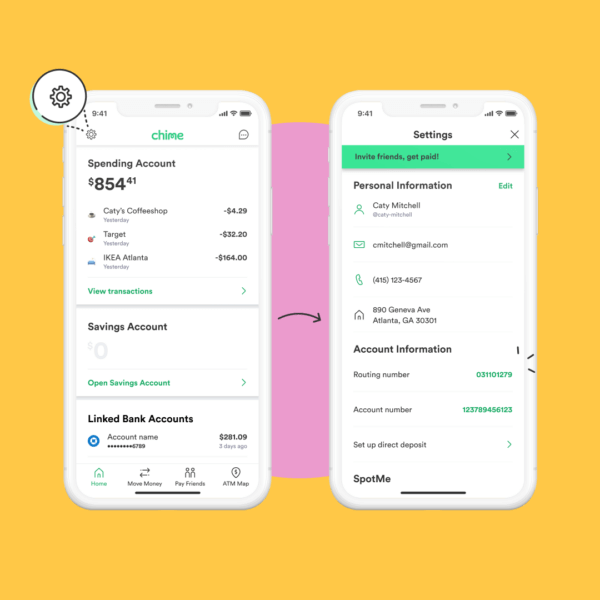

Sign up for Direct Deposits

The first step to begin with direct deposits is to sign up to Chime. However, if you have an account, just log in and start with the process. To sign up to Chime, you need your name, Social Security Number(SSN), and Email. Now you can share your Account number and the routing number present in the Move Money Tab with the employer. Your account is all set to receive direct deposits. You can also hold your deposits by providing Chime’s FDIC Insured Partner banks.

Working

Chime Direct Deposit works just like any other bank’s Direct Deposits. Before reaching your bank, the Direct Deposits pass through a series of processing. The process has to be done as it is a compulsory procedure. Chime has no right to interfere in the process. Hence, Chime notifies you only when the direct deposits reach the bank after completing the process.

Time taken by Direct Deposits

The time taken by Direct Deposits depends entirely on the processing period. Chime informs you at the same moment when it receives the deposit.

Chime allows a maximum of three deposits per day. The direct deposit limit is $1000 per day and $10,000 per month. Deposits are also made through third-party sources. If you use a third-party money transfer to add funds to your account, they will impose their terms and conditions. You cannot violate their limitations and have to pay the fees charged by them.

Deposits tend to set back due to the holidays observed by the Chime Bank. The Chime Bank is non-working during federal and bank holidays. These include New Year’s Day, Independence Day, Labor Day, and so on. The complete list of Chime’s holidays can be found on the Chime official website.

Chime Direct Deposits quickens your payments and help you save a lot of time. You can also avail Chime Spotme Services by keeping a regularity in Direct deposits. Chime Direct Deposits also give you the advantage of receiving your payments two days earlier than other banks.

Chime Bank Direct Deposit Info

However, these deposits also have a limit. The Chime Direct Deposit limits cannot be tampered with. But, you should maintain a better account history to avail the extra benefits. Chime keeps an eye on your transactions and rewards you from time to time to encourage continuous working on the account. Chime Direct Deposits are faster than other banks, but they too are affected by federal and bank holidays. Still, Chime is always at the topmost position among other neobanks.

Whether you’re an employee, independent contractor or somewhere in-between, there’s no denying that getting paid is important. But it can be a drag to go to the bank or use a mobile app to cash or deposit a check. That’s why direct deposit is a great option if you’re looking to access your cash quickly.

Direct deposit is a payment option where your funds are electronically transferred to your checking or savings account. This can help the payee receive payment faster and avoid dealing with physical checks.

In many cases, direct deposit means your payroll checks are automatically deposited into your bank account. You would typically set up this type of direct deposit with your employer. But, you can also use direct deposit for tax refunds and other types of payments. The benefit of direct deposit is that funds are seamlessly transferred from the payer to the payee. Like the name suggests, the funds are directly deposited into a bank account for easy and quick access.

If you want to avoid cumbersome checks and ensure you get paid quickly, signing-up for direct deposit is key. Whether you sign-up for direct deposit through your employer, a vendor or another company, typically the process is the same.

Of course, each company may have different forms you need to fill out to process the request. In all likelihood, you’ll need the following types of information:

- Your bank routing number

- Your account number (this is the account you want the funds to go into)

- Your bank’s address

- A voided check

You can think of your routing number as an electronic address that helps ensure that the funds are going to the right neighborhood. Your specific and unique account number, on the other hand, is like your financial home. Both of these numbers help specify exactly where your money should go when you set up direct deposit.

Lastly, your bank’s address and a voided check may be used for additional verification as part of the direct deposit set-up process.

After you learn how to set up direct deposit, you may then want to know how long direct deposit takes to go into effect.

In some cases, it can take one to two pay cycles for direct deposit to be set up properly. This may mean you’ll still have to use physical checks for a little while longer until everything is set up.

Once direct deposit is ready, exactly when your funds will hit can vary depending on factors like what type of payroll software your employer uses and when payroll is submitted. This is important to understand, especially if you are setting up automatic transfers. For example, if your direct deposit won’t hit until 9am on a business day, but an automatic transfer is taken out earlier than that, this can cause problems. Instead, find out exactly when your funds will be available and then schedule your bill payments and automatic transfers after your payment hits.

It’s also important to note that in some cases your financial institution may put a hold on your funds for a couple of days before releasing the money into your account. For this reason, early direct deposit features can be a complete game-changer.

Early direct deposit allows you to access your funds faster than most traditional banks.

There’s nothing worse than knowing that you should already have your money – but your funds are on hold. You have bills to pay and a life to live. If your funds are on hold and you make a payment and don’t have enough in your account, it can spell trouble and even lead to hefty fees like overdraft fees.

That’s why when you direct deposit with Chime, you get access to features early direct deposit¹, overdraft without fees², and more!

Bottom line

If you’re offered the option to sign-up for direct deposit, it’s always a good idea. It not only minimizes paperwork and c